When They Came for the Beach is a novel inspired by actual events. Both fictional characters and real people appear within its pages. Any similarity of a fictional character to a person living or dead is purely coincidental. Real people are referred to by name and care has been taken to accurately and reliably present the dialogue and events attributed to them.

The purpose of When They Came for the Beach is educational and therefore this annotated bibliography has been provided as a companion document. It is hoped that readers interested in separating fact from fiction, or in exploring in more detail the issues and actual events raised in the book, find answers in this bibliography.

If, after reviewing the bibliography, comments, suggestions or questions remain, please contact the author.

2013

SUMMER

“There’s a reason there’re no meeting notes.”

Uechi, Jenny, Meetings between Kinder Morgan and feds leaves no paper trail, National Observer, February 23, 2015.

Records of meetings between lobbyists and federal government representatives are maintained through the Lobby Registry of the Office of the Commissioner of Lobbying of Canada.

An Access to Information and Privacy (ATIP) request submitted by the author for meetings held between Ministers and senior government officials and Kinder Morgan in 2013 and 2014, revealed there were many meetings where no records, no agenda, no minutes, no notes, were kept. ATIP response in author’s possession.

McCarthy, Shawn, Oil industry successfully lobbied Ottawa to delay climate regulations emails show, Globe and Mail, November 8, 2013.

Steward, Gillian, Oil industry association a powerful lobby in Ottawa, September 4, 2015.

“They’ve been shipping oil safely for decades. It won’t spill. If it does, it’ll get cleaned up.”

Trans Mountain’s website (Accessed March 30, 2019) states, “We’ve been safely moving oil through the Trans Mountain Pipeline and loading tankers at our marine terminal for almost 65 years. During that time, we’ve developed comprehensive safety, spill prevention and emergency response plans to make sure we’re protecting the public, the environment and our employees.”

Tsleil-Waututh Nation, Sacred Trust, What is Kinder Morgan’s Record of Spills, Website.

Gunton, Thomas, Five myths about the Trans Mountain Pipeline, Times Colonist, April 12, 2017.

Stoness, Scott, Five truths about the Trans Mountain Pipeline, Times Colonist, April 25, 2017.

Nagel, Jeff, Oil & Water—Part I: How safe are oil tankers travelling southern B.C. waters?, Peace Arch News, April 12, 2012.

Chow, Wanda, Oi & Water—Part II: What happens if there’s an oil spill in B.C.?, Peace Arch News, April 12, 2012.

Nagel, Jeff, Oil & Water—Part III: Is B.C. destined to be Alberta’s oil superport?, Peace Arch News, April 12, 2012.

Kat interrupts. “Well, you won’t have to worry about feeling like that much longer. Pretty soon there’s going to be a bunch of supertankers out there. It won’t be so beautiful here then.”

National Energy Board, Application for Trans Mountain Expansion Project (OH-001-2014), Marine Transportation Assessment, Volume 8A, Exhibit B18-20, A2S4X4, December 17, 2013, Page 8A-65.

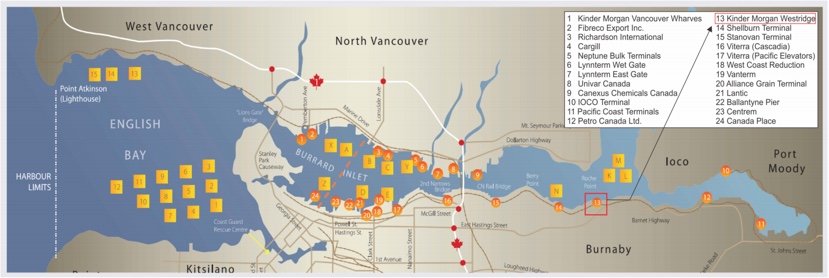

There are 15 marine anchorage spots in English Bay where crude oil tankers can moor. These anchorages are identified by the numbers 1-15 in the map below. Sunset Beach is adjacent to 12 of them, while the remaining three are across the bay off the coast of West Vancouver.

"There’s a Kinder Morgan pipeline that comes from Edmonton to BC. It carries about three hundred thousand barrels a day. Most is light oil that goes to Washington State, but the company wants to build another pipeline to send oil sands crude directly to its dock in Burnaby, where it’ll be loaded onto supertankers destined for foreign markets.”

National Energy Board, Application for Trans Mountain Expansion Project (OH-001-2014), Hearing Site, December 16, 2013.

The largest tanker capable of transiting Burrard Inlet is an Aframax. This size of vessel is considered by some to be a supertanker, while others do not put it in that category.

“It’s called the Trans Mountain Expansion Project,” adds Liz. “It’s going to increase the number of berths at the Westridge dock to three and the number of oil tankers that call there to thirty-four a month. Kat’s right. It’s going to be really crowded out there.” Liz nods to English Bay.

National Energy Board, Application for Trans Mountain Expansion Project (OH-001-2014), Summary Volume 1, Exhibit B1-1, A3S0Q7, December 16, 2013, page 1-12.

“The expanded system will be capable of serving 34 Aframax class vessels per month, with actual demand driven by market conditions.”

“Trans Mountain’s existing pipeline crosses more than eleven hundred streams and rivers…”

National Energy Board, Application for Approval of the Transportation Service and Toll Methodology for the Expanded Trans Mountain Pipeline System (RH-001-2012), Exhibit C15-12, Transcript of Ian Anderson Investor Presentation, February 13, 2013, page 4.

“So, built in 1953, it crosses over 1100 streams and rivers and water crossings…”

“They already load crude oil onto five tankers a month at Westridge.”

National Energy Board, Application for Trans Mountain Expansion Project (OH-001-2014), Summary Volume 1, Exhibit B1-1, A3S0Q7, December 16, 2013, page 1-12.

“Currently in a typical month, five vessels are loaded with heavy crude oil at the terminal.” (emphasis added)

Kinder Morgan misled the NEB and the public. There are fewer than five vessels loaded in a typical month and fewer still loaded with heavy crude oil, since light oil is also delivered at the dock.

“There are three major upsides,” Kat says. She raises her index finger. “One, all the jobs that come with building the pipeline and then operating it.”

Allan, Robyn, The search for Trans Mountain’s mythical 15,000 construction jobs, Vancouver Province, August 28, 2017.

The jobs figures have been egregiously exaggerated. The most common construction jobs figure relied upon by government officials and Kinder Morgan is 15,000.

However, Kinder Morgan told the National Energy Board in its application that construction jobs would reach an average of 2,500 person-years of employment for a maximum of two years.

National Energy Board, Application for Trans Mountain Expansion Project (OH-001-2014), Volume 5B, Exhibit B5-38, A3S1S7, December 16, 2013, page 7-717.

National Energy Board, Application for Trans Mountain Expansion Project (OH-001-2014), Volume 5B, Exhibit B5-38, A3S1S7, December 16, 2013, page 7-787.

There are only 90 permanent jobs from operating the expansion. “The number of permanent additional workers during the operations phase (90 new permanent positions total across the Socio-economic RSA)…” page 7-187.

She raises her middle finger. “Two, the corporate tax revenue from Kinder Morgan’s profits when they operate the pipeline.”

Allan, Robyn, Trans Mountain Pipeline: Big Bucks for US Investors Peanuts for Us, The Tyee, November 17, 2014.

With respect to corporate tax revenue, as explained in the article above, Kinder Morgan is structured to avoid paying taxes in Canada rendering false the claims that operating the pipeline would deliver corporate tax revenue. Kinder Morgan maintained that its corporate structure was outside of the scope of the review of the hearing.

The NEB refused to consider how Kinder Morgan’s tax avoidance contradicted the company’s claim of corporate tax revenue from operating the Project, ruling that Kinder Morgan’s tax structure was outside the scope of its review.

The NEB chose to rey on analysis submitted by Kinder Morgan—and undertaken by the Conference Board of Canada—that effectively invented corporate tax revenue from the project when the NEB knew the model the Conference Board relied upon did not reflect Kinder Morgan’s business reality. The Conference Board did not check with Kinder Morgan to ensure its model reflected reality.

National Energy Board, Trans Mountain Expansion Project, Trans Mountain Response to Robyn Allan Information Request No. 1, A3X5V9, June 4, 2014, Section 1.03 Trans Mountain Operating Revenue and Tax Liability, page 30 to 44.

She raises her ring finger. “And three, the higher price on every barrel of oil supplied when new markets are open to us. The increased revenue to oil producers is going to be thirty-eight billion dollars.”

Earnest, Neil, Muse Stancil, Update of Market Prospects and Benefits Analysis, Northern Gateway Application, Exhibit B83-3, A2V1R7, July 20, 2012, page 7.

The thirty-eight billion dollars in revenue benefits to oil producers that Kat refers to comes from the benefits report submitted to the NEB review as part of Enbridge’s Northern Gateway hearing (available in the link cited above).

Kat refers to Earnest’s report because, although Kinder Morgan commissioned consultant Steven Kelly to estimate revenues to producers from Trans Mountain’s expansion and included this report in its application, Kinder Morgan would not submit its Application to the NEB until December 2013.

The producer revenue benefit claim of thirty-eight billion is based on a flawed ‘netback analysis’ model. The premise of the netback approach is that when supply increases and there is not enough pipeline capacity to deliver that increased supply to market, the tar sands crude selling price falls relative to the North American benchmark crude price, West Texas Intermediate (WTI).

The author was an expert witness on behalf of the Alberta Federation of Labour at the Northern Gateway NEB review. The author’s critique of Earnest’s report was filed by the Alberta Federation of Labour at that hearing. The report is available through the link provided below.

Allan, Robyn, An Economic Assessment of Northern Gateway, Exhibit , D4-2-49, A2L7D1, January 31, 2012, Page 47 – 62.

Netback analysis is an ineffective and fundamentally flawed approach to measuring impact from new pipeline capacity.

Netback analysis is the basis upon which claims that ‘millions of dollars a day’ are being lost because pipelines are not built. These claims include the ‘fifty-million a day loss’ made popular in 2012 – 2013 and the more recent $15 billion a year loss claim advanced by Scotiabank ($40 million a day) and embellished by former Alberta Premier Rachel Notley. Notley doubled the Scotiabank figure to arrive at an $80 million a day claim. All such clams of ‘loss’ are without substance but Notley’s claim of $80 million a day is the most egregious.

Allan, Robyn, Scotiabank report a work of fiction, Vancouver Sun, March 4, 2018.

Allan, Robyn, Premier Notley’s claimed $15 billion annual benefit from Trans Mountain exposed as false by her own budget, National Observer, June 7, 2018.

Allan, Robyn, False oil price narrative used to scare Canadians into accepting Trans Mountain Expansion, National Observer, November 26, 2018.

Allan, Robyn, Cenovus CEO should get facts straight, Times Colonist, February 2, 2018.

Allan, Robyn, The discount for Alberta’s oil isn’t always that steep, Calgary Herald, February 24, 2018.

Allan, Robyn, Bitumen’s Deep Discount Deception and Canada’s Pipeline Mania: An Economic and Financial Analysis, April 2, 2013.

Netback analysis is without merit for a number of reasons, the most significant among them being the fact that few barrels are subjected to the spot market differential price between Western Canadian Select (WCS) and West Texas Intermediate (WTI).

The articles cited above explain how oil producers protect themselves from exposure to spot market pricing.

In addition to the fact that netback analysis is fundamentally flawed because it is applied to all barrels as if they are all exposed to spot pricing when the market reality is much different, netback analysis is dependent upon reliable and accurate supply projections. The supply forecast that was relied upon to predict both the Northern Gateway and the Trans Mountain revenue benefits was exaggerated.

Allan, Robyn, Trudeau’s oil sands supply outlook reflects a future that doesn’t exist, National Observer, January 25, 2019.

National Energy Board, Living Oceans Society, Supplemental Written Evidence, Public Interest Evaluation, Gunton et.al., Exhibit C213-30-1, A4W0R4, December 1, 2015, page 10.

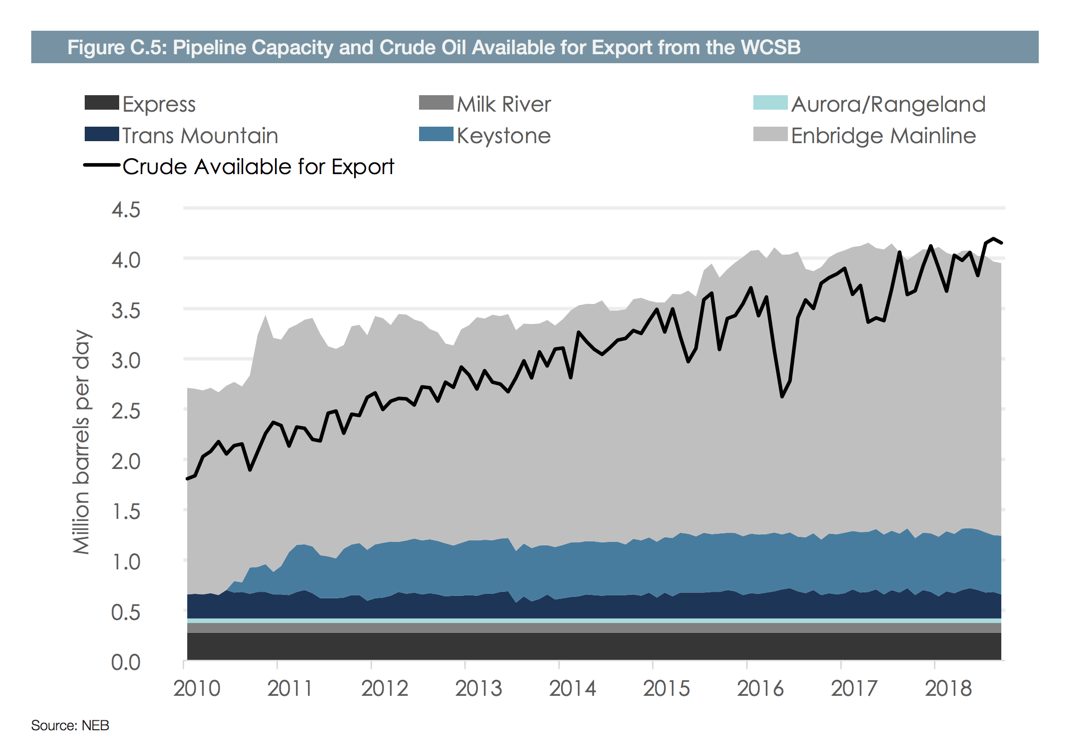

“Multinational oil companies, Canadian oil companies—they’re all investing in oil sands expansion, so supply’s going to grow no matter what. Even if they don’t get a pipeline to the West Coast, oil producers will increase supply by more than two million barrels a day beyond where it is now, and that’s within a decade. At least that’s what the industry association tells our firm they’ll do. They have to get that oil to market one way or another, and they would rather send it west than south.”

CAPP, Forecast, Markets and Transportation June 2013, page 37.

Kat is referring to the 2013 CAPP supply outlook and the claim by the industry associations and pipeline proponents that the same amount of supply will be provided whether or not sufficient pipeline capacity exists to deliver the supply to market, and irrespective of changes in market price, world demand, ecological destruction, etc. That is, only one scenario of rapidly growing future supply is provided to regulators. In this way, pipeline proponents can pretend no market forces, political realities, or environmental limitations will get in the way of rapid tar sands expansion for decades into the future.

The table provided on page 37 of CAPP’s 2013 report, indicates that in 2012, tar sands supply was 2,166 thousand barrels a day, by 2021 the outlook says, 4,319 thousand barrels a day will be supplied—for a difference of 2,153 thousand barrels a day which is why Kat says there will be “more than two million barrels a day beyond where it is now—within a decade.”

Throughout the Northern Gateway and Trans Mountain Expansion hearings, Enbridge and Kinder Morgan maintained that there would be no impact on tar sands supply if their respective projects were not built. See Earnest (2012), page 48 where there is only one supply forecast he relied upon—the same supply forecast with or without the expansion. Similarly, see Earnest (2015) page 60 where there is only one supply forecast relied upon for his scenario with or without the expansion.

“Who to?” I ask. “The Chinese. They’re growing their economy like crazy and they need more oil.”

Allan, Robyn, Need for, Commercial Feasibility, and Economic Impact of the Trans Mountain Expansion Project, Prepared for Tsleil-Waututh Nation, November 26, 2016.

No evidence has been provided by Kinder Morgan, Trans Mountain’s new owner the government of Canada, its consultants or oil producers that markets in Asia exist for Alberta’s heavy oil despite ongoing claims by the federal and Alberta governments that there is a market.

The author prepared an expert report for Tsleil-Waututh Nation, the Indigenous Peoples that live on the shores of Burrard Inlet across from the Westridge dock. The report examined, among other issues, the claim that markets in Asia exist for Alberta’s diluted bitumen and that in these markets, refiners would be willing to pay higher prices than prices paid in the US. The author could find no evidence that this is the case.

When the Mexican National Oil Company, Pemex, attempted to penetrate the Asian market with Maya, a heavy crude similar to Canada’s Western Canadian Select (WCS), their attempts failed. Pemex fount it needed to decrease its prices in order to sell a greater quantity into the Asian market. Even after lowering prices, Pemex could not receive orders for the quantity it wished to deliver. Pemex was attempting to sell fewer barrels than Kinder Morgan has said would be delivered to Asia along Trans Mountain’s expansion.

As stated in the author’s report, “Existing information confirms that heavy crude oil markets in Asia are limited and extremely difficult to penetrate. In recent years Mexico, through its national oil company, PEMEX, sought to increase its share of the Asian heavy oil market. PEMEX produces Maya, a grade similar in quality to Alberta’s benchmark heavy oil, Western Canadian Select (WCS). Canadian heavy oil competes with Maya in the Gulf Coast. As Graph 4 illustrates, Maya volumes exported into the Asian market peaked at about 140,000 barrels a day in 2015, declining to about 120,000 barrels a day in 2016.” Page 19.

Trans Mountain’s application claims that 540,000 barrels a day of dilbit will begin to make its way to Asia immediately upon completion of the project. There is no market reality or market research to support this claim.

Tsleil-Waututh Nation, Sacred Trust, Website.

Tsleil-Waututh Nation submitted the author’s economic report along with three other expert environmental risk reports as part of the Nation’s consultations with Ottawa in November 2016. The day after receiving the reports, Ottawa announced that the expansion had been approved which meant the contents of the four expert reports could not have been considered by the federal government. This is an example of the irresponsible approach Mr. Trudeau’s government took during its consultations with First Nations.

“The National Energy Board,” she confirms. “For a public hearing like this, there are three panel members selected from the full board, and the panel is headed by a chairperson.”

NEB Website, Participating in NEB Hearings.

NEB Website, Board Members.

For Trans Mountain’s public interest hearing, the Panel Members were David Hamilton (Chair), Alison Scott and Phil Davies.

For the Reconsideration Review the three members appointed were: Lyne Mercier (Chair), Alison Scott and Murray Lytle.

Kat talked about a trade-off; we get economic benefits from delivering oil to China, but we face lost quality of life and harm to the environment. How much is an oil pipeline worth, and who gets the money? How does ruining English Bay get simplified into an equation, and who defines the algorithm? How do they tally the economic gain for some and determine if it outweighs environmental loss to others? Alberta, where the oil’s extracted, already owes me a night’s sleep. Where do I send an invoice and how do I collect?

National Energy Board, National Energy Board Report, Trans Mountain Expansion Project, OH-001-2014, May 2016.

The NEB adopted an algorithm to recommend approval for the Trans Mountain Expansion Project by weighing project benefits against residual burdens. Residual burdens are defined as the burdens that cannot be mitigated through conditions attached to the project. The Board’s reliance on this algorithm means accurate and reliable estimates of benefits and burdens are critical. If benefits outweigh burdens, the NEB decides the project is in the public interest. By exaggerating benefits and downplaying burdens (risk), the NEB’s formula will lead it to err in its conclusion that the project should proceed. See page xii-xv of the NEB Report for the discussion regarding the NEB approval formula.

Allan, Robyn, Transcript from Burnaby Public Forum Hosted by MP Terry Beech, September 7, 2016.

The presentation presented at Beech’s Public Forum explains the NEB ‘trade-off’ formula.

The NEB report determined that economic benefits from the project outweighed residual burdens. The benefits the Board relied on were markets in Asia, improved crude oil prices leading to producer revenue benefits, government revenues (corporate taxes) from Kinder Morgan’s operating profits and jobs. These benefits were compared to fresh water and marine spill risk, greenhouse gases from tankers and extinction of the Southern Resident Killer Whales (Orcas). However, the Board did not examine the impact of marine traffic as required by the Canadian Environmental Assessment Act (CEAA) or under the Species at Risk Act (SARA). Therefore, the assessment the Board made was only conducted under the NEB Act, which is far less stringent than that required by CEAA and SARA.

The Board determined in its May 2016 report that the benefits were greater than the risk. However, the Board relied on exaggerated benefits, and under-estimated risks in order to arrive at this conclusion. This approach by the NEB—to exaggerate benefits and downplay burdens—continued with its Reconsideration Hearing. The Reconsideration Report filed in February 2019 relied on the same financial and economic information as contained in its May 2016 report. The financial information was submitted in December 2013 and the economic information in September 2015. The question that has yet to be addressed by the NEB or Ottawa is ‘why would benefits based on a financial reality of 2013 and a market reality of early 2015 be relied upon to recommend approval for a project in 2019. Both the financial and economic reality have fundamentally changed. For example, the NEB’s 2019 report says Kinder Morgan is the owner of Trans Mountain and the project will cost $5.5 billion to build. The supply forecast is fundamentally flawed, and projects rapid tar sands expansion, when in fact supply growth will peak in the early 2020s and begin to decline.

Allan, Robyn, Trudeau’s oil sands supply outlook reflects a future that doesn’t exist, National Observer, January 25, 2019.

Allan, Robyn, Letter to Minister Carr, September 14, 2016.

There’s a reference to an oil industry association supply forecast. It tells me that in 2012 slightly more than two million barrels a day of oil sands crude were supplied. The industry plans to double that within nine years. By 2021, the report says, it’ll be up to just over four million barrels a day. That’s the two million barrels a day increase that Kat said urgently needs to get to market. Why is it urgent if they haven’t already produced it? I make a note to contact Kat and talk to her about the reliability of the supply projections.

CAPP, Forecast, Markets and Transportation June 2013, page 37.

CAPP releases its supply outlook every June and bases its projections on a survey of oil producer intentions. In this respect CAPP’s outlook is not a ‘forecast’ as generally regarded in economic analysis, it is an ‘outlook’. Since it is a survey of intentions from CAPP’s members and these members seek to have a pipeline approved, there is an inherent conflict of interest in the development of the figures and as a result, CAPP’s figures suffer from an upward bias.

Allan, Robyn, Need for, Commercial Feasibility, and Economic Impact of the Trans Mountain Expansion Project, Prepared for Tsleil-Waututh Nation, November 26, 2016, page 8.

CAPP does not forecast supply based on crude oil prices. CAPP provides a survey to its members and they respond using their own internal view of the long-term oil price. CAPP assumes that the future price will be sufficiently high enough that investment will be made in the projects that underlie rapid future growth in supply. The survey approach CAPP relies on means there is significant risk to the supply outlook because investments may not be made in those projects and therefore rapid supply growth may not occur.

“I look at the headline and read it out loud. “Radical Groups Undermine Oil Sands Future: Ottawa.”

Natural Resources Canada, An open letter from the Honourable Joe Oliver, Minister of Natural Resources, on Canada’s commitment to diversify our energy markets and the need to further streamline the regulatory process in order to advance Canada’s national economic interest, January 9, 2012.

Payton, Laura, Radicals working against oil sands, Ottawa says, CBC, January 9, 2012.

Ljunggren, David, Canada blasts foreign “radicals” opposing pipeline, Reuters, January 9, 2012.

“Engineers and geologists called it tar sands back in the 1940s,” I tell Barbara. “The industry always called it tar sands until the 1990s. But then an oil association didn’t like the term. Give me a minute.” I read further. “Of course. Tar sands too dirty for oil lobbyists. The Alberta government and industry worked together on a campaign to rebrand it as ‘oil sands.’”

Paskey, J., Steward, G., and Williams, A., The Alberta Oil Sands Then and Now: An Investigation of the Economic, Environmental and Social Discourses Across Four Decades, Mount Royal University, August 2013, page vi.

“Get this. It’s not even oil sands. It’s bituminous sand. ‘A mixture of sand, clay, water and extremely viscous’—that means thick and sticky—'form of petroleum called bitumen.’”

Galius, Jeff, Is it tar sands or oil sands, Alternatives Journal, September 2012.

“Bitumen is a ‘combination of sulphur, nitrogen, salts, carcinogens, heavy metals and other toxins.’ It says here that it has to be upgraded into synthetic crude oil before most refineries can turn it into petroleum products.”

Galius, Jeff, Is it tar sands or oil sands, Alternatives Journal, September 2012.

Grey, Murray, Tutorial on Upgrading of Oilsands Bitumen, University of Alberta.

“No,” I interrupt. “Looks like bitumen’s for export only. BC’s a super highway over the Rocky Mountains, across more than a thousand freshwater rivers and streams, and through a densely populated urban centre. Then we’re a parking lot for this oil. Our province is only good for transporting bitumen to foreign markets. You know, ‘Just passing through. Sorry if we ruin your environment.’”

National Energy Board, Application for Trans Mountain Expansion Project (OH-001-2014), Earnest, Neil, Market Prospects and Benefits and Analysis of the Trans Mountain Expansion Project, Final Clean, Muse Stancil, Exhibit B431-2, A4U8F8, October 28, 2015, Table A-9, page 70.

“The ‘dil’ is short for diluent, which is condensate, but what’s condensate?” Barbara chuckles. “I was just going to ask that.” “Ah, ultra-light oil from natural gas or fracked shale oil fields; highly toxic when airborne,” I read out loud.

Encana, Safety Data Sheet, Natural Gas Condensate, August 15, 2013.

ConocoPhillips, Safety Data Sheet, Crude Condensate, April 2, 2012.

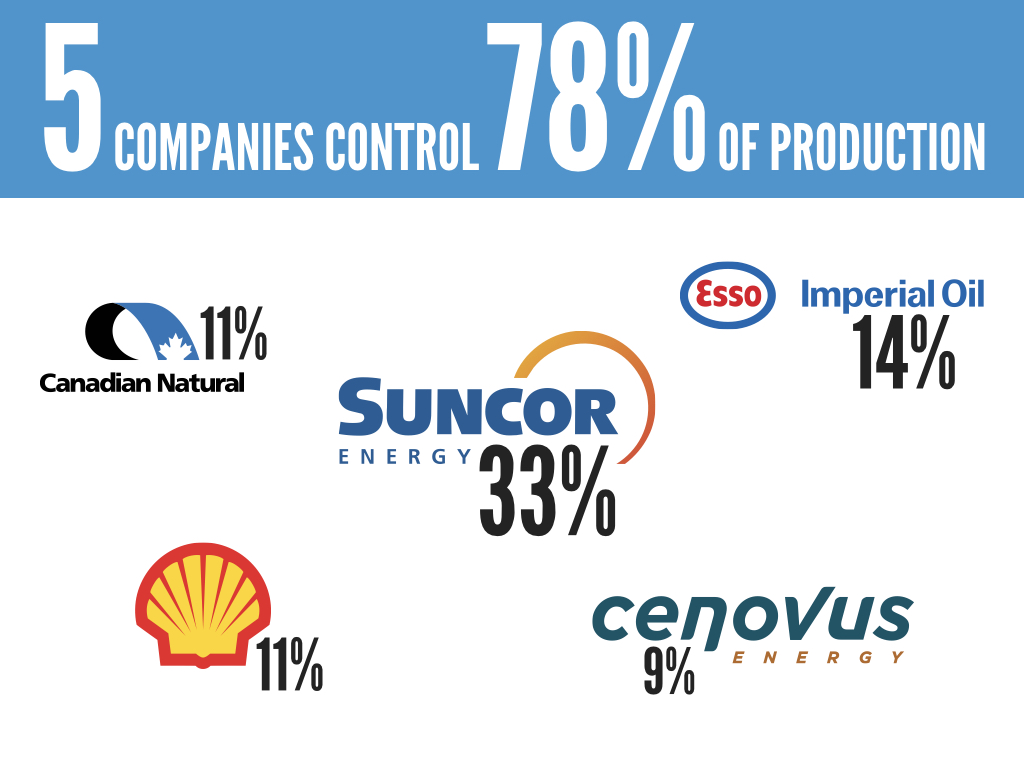

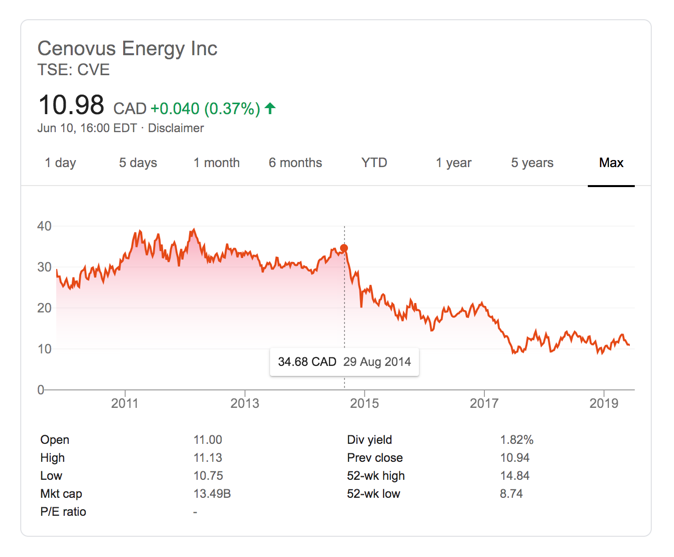

“Suncor, Imperial Oil, whose parent is ExxonMobil, Shell, Canadian Natural Resources and Cenovus are the biggies, and it looks like between them they make up about eighty percent of all bitumen production.”

Allan, Robyn, Pipelines and Oil Tankers: Economic Cost and Environmental Risk, November 14, 2013.

Who are these tar sands companies?

Five multinational oil companies control 78% of the current tar sands production. These companies are Suncor, Imperial Oil (whose parent is ExxonMobil), Shell, Canadian Natural Resources and Cenovus.

The table above reflects the roster of major companies in 2013 based on statistics compiled by the author as provided in: Alberta Government, Oil Sands Industry, Quarterly Update, Summer 2013.

“Get this, Babs. Canada has to import most of the diluent. I stop reading and look at her. “Guess where from?” “The US?” she asks sarcastically. “How did you guess? These guys can’t even honestly stamp ‘Made in Canada’ on the barrels they ship. Extracting a raw resource, mixing it with US condensate, and shipping it to Asia for upgrading and refining isn’t developing Canada’s resources,” I say. “It’s exploiting them.”

Allan, Robyn, Pipelines and Oil Tankers: Economic Cost and Environmental Risk, November 14, 2013.

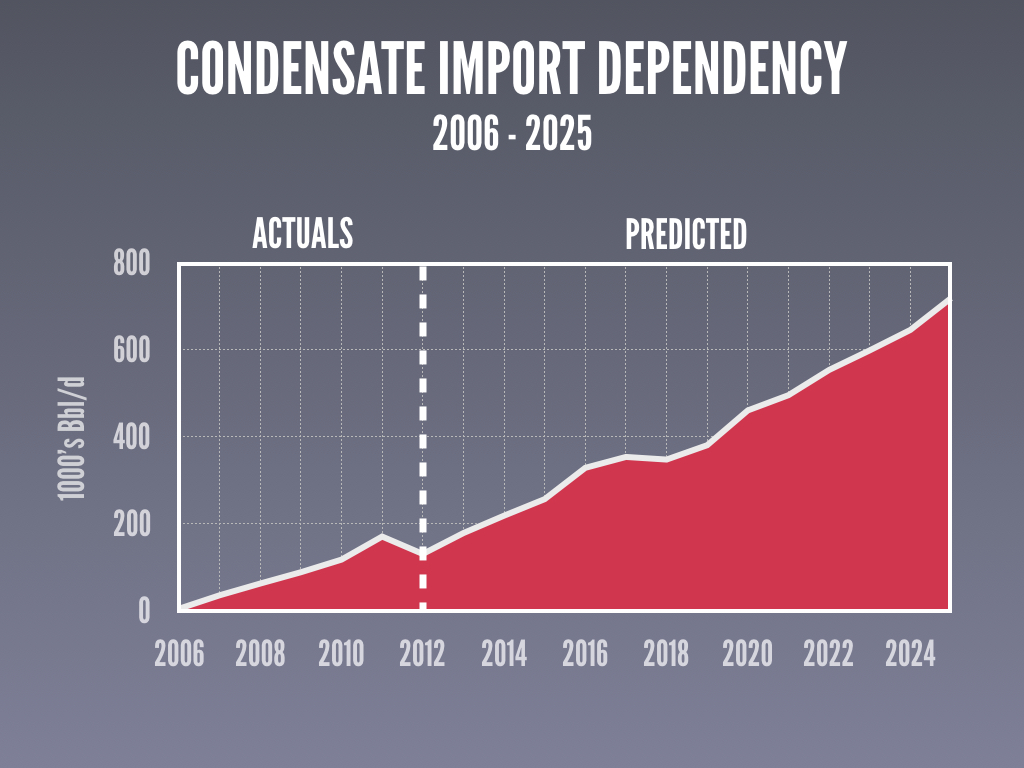

Up until 2005 Canada was self-sufficient in condensate production. When we produced a barrel of bitumen and mixed it with domestically produced condensate to make diluted bitumen, we exported a barrel of diluted bitumen, or what the industry refers to as dilbit.

Not true anymore.

By 2006 condensate demand began exceeding domestic supply. Tar sands producers started importing it from the US.

“Why are tar sands exploiters—excuse me, I mean oil sands developers—planning to ship dilbit out of the country, if this is supposed to be good for Canada’s economy? Why wouldn’t oil producers make petroleum products right here at home?”

Allan, Robyn, Keep the oilsands’ wealth at home, Vancouver Sun, May 17, 2012.

The Alberta Energy Regulator website has a wealth of information that goes back decades. Documents from 2007 explain that oil producers knew perfectly well they should be investing in infrastructure in Canada. They planned to build seven upgraders, but didn’t. Hmm, why not? I Google “investing in upgraders” and click on the article, “Keep the oilsands wealth at home.”

Alberta Energy Regulator, Website.

Alberta Energy Regulator, ERCB ST98-2009: Alberta’s Energy Reserves 2008 and Supply / Demand Outlook, June 2009, page 1-6.

“Further expansion of upgrading capacity, refinery conversions, and more pipeline access to new markets should help stabilize these differentials over the longer term. There are currently three bitumen upgrading sites in Alberta, with seven additional upgraders and a number of debottlenecking and expansion projects planned during the forecast period.”

Alberta Royalty Review 2007, Oil Sands Economics and Royalty Series, Appendix A Technical Report OS#1, Markets and Pricing for Alberta Bitumen Production, Alberta Department of Energy, page 20-21.

Appendix A provides a compendium of the strategies oil producers rely on to protect the tar sands crude barrels they produce from the spot market price.

Allan, Robyn, Keep the oilsands wealth at home, Vancouver Sun, May 17, 2012.

“In the 1950s, yeah. But a decade ago, the province changed the law so Kinder Morgan could buy Trans Mountain. It was done when Gordon Campbell was premier. Remember the guy convicted of drunk driving in Hawaii?”

Dobbin, Murray, Terasen Sale must be Snuffed, The Tyee, September 15, 2005.

Mair, Rafe, How we got Screwed on Terasen Deal, The Tyee, August 15, 2005.

Mickleburgh, Rod, Drunk driving charge for Campbell, Globe and Mail, January 11, 2003.

“Hear me out. Kinder Morgan’s run by Richard Kinder. He used to be the number-two guy at Enron. You know, that huge American company that lied to everyone about how it made its money and went bankrupt because of massive accounting fraud.”

Allan, Robyn, How Trans Mountain Project Will Pump Profits to Its Texas Based Owners, The Tyee, January 12, 2015.

“Morgan’s retired, but Kinder doesn’t even mention Enron in his corporate bio. Neither does Kinder’s second-in-command, Steve Kean, who was an executive vice-president at Enron when it failed.”

Kinder Morgan Website, Richard D. Kinder, Bio.

Kinder Morgan Website, Steven J. Kean, Bio.

Bloomberg, Steven J. Kean, Executive Profile.

Steven Kean was executive vice-president and chief of staff at Enron when it failed.

“See, the US District Court and the Securities and Exchange Commission found Jordan Mintz, Enron’s tax guy, guilty. Now he’s head of tax planning at Kinder Morgan.” Kat begins to read the document. “It says he failed to disclose millions of dollars in payments and engaged in misleading and fraudulent statements in Enron SEC filings. That’s pretty serious.”

United States of America before the Securities and Exchange Commission, In the matter of Jordan H. Mintz, January 26, 2009.

“Among other things, the Commission’s complaint alleges that Mintz … intentionally failed to disclose in Enron’s 2000 proxy statement millions of dollars paid to the former Chief Financial Officer, Andrew Fastow. The complaint further alleges that Mintz completed a fraudulent related party transaction with an entity controlled by Fastow and failed to disclose the transaction when required in Enron’s 2000 proxy statement. The complaint also alleges that Mintz … made misleading statements regarding the Fastow related entities in Enron’s second quarter Form 10-Q.”

US Securities and Exchange Commission, Litigation Release No. 20866, January 26, 2009.

Allan, Robyn, How Trans Mountain Project Will Pump Profits to Its Texas Based Owners, The Tyee, January 12, 2015.

Witt, April and Behr, Peter, Enron’s Other Strategy: Taxes, Washington Post, May 22, 2002.

“He’s sceptical that Trans Mountain’s expansion will improve oil prices, so he wants a detailed analysis of the claims about revenues.”

Vanderklippe, Nathan, New BC pipelines won’t fetch higher oil price: Imperial Oil, Globe and Mail, September 7, 2012.

“On every barrel?” I ask. “Don’t you mean just on the barrels that would go to new markets along Trans Mountain?” “No. On all barrels.” “That doesn’t make sense.”

Earnest, Neil, Muse Stancil, Update of Market Prospects and Benefits Analysis, Exhibit B83-3, A2V1R7, July 20, 2012, page 70, Table A-18.

The benefits estimated by Mr. Earnest were arrived at by applying a price increase against all crude oil supplied. He relied on supply (based on CAPP 2011) taken from Table A-1 in his report, times the price increase estimated for each grade of oil as per Table A-17, multiplied by 365 days to arrive at the annual estimated revenue benefit provided in table A-18. He aggregated each of the revenue benefits, by grade, by year, to arrive at thirty-eight billion dollars. Mr. Earnest seems unaware that very few barrels are actually exposed to the spot market price. This error renders his benefits estimate without merit because it does not reflect market reality.

“Right now, West Texas Intermediate is selling for a hundred and five dollars a barrel, and Western Canadian Select oil sands crude, for example is being sold at fifteen dollars a barrel less—so for ninety dollars a barrel.”

Baytex Energy Website, Benchmark Heavy Oil Prices, (Accessed May 23, 2019), See July 2013 prices for WTI and WCS.

“So you’re saying some of the biggest companies in the world are going to keep pumping tar sands crude, purposely oversupply the market and when they do that it causes its price to fall. Then they build another pipeline to recover the price for tar sands crude they had to begin with?” I ask. “It sounds like they aren’t actually losing money, are they?”

Allan, Robyn, Bitumen’s Deep Discount Deception and Canada’s Pipeline Mania: An Economic and Financial Analysis, April 2, 2013.

Bitumen’s Deep Discount Deception was written to provide research and analysis on whether the discount narrative that was being advanced during the period 2012 – 2013 had any merit. Oil producer profits were rising all through that period, despite the marketing of misinformation to the media that the industry was ‘losing’ $50 million a day.

As explained in the report cited above, “Wider differentials between poor crudes and light crudes in North America do not mean lower prices for Canadian bitumen or lower profits for the oil sands industry. The prices for western Canadian crude have increased significantly over the last number of years.” Page 4.

Various tar sands producers explained to their shareholders during the 2012 – 2014 period that they were not losing money because of the spot market price since they were afforded protection by their integrated business strategies. For example, Imperial explained how its earnings were enhanced by a wider differential during its Investor Days presentation in early 2014.

Imperial Oil, 2014 Investor Day Presentation, Transcript, April 1-2, 2014. Imperial Oil, 2014 Investor Days Presentation, Slides, April 1-2, 2014.

Imperial Oil’s Investor Days transcript from 2014 explains, on page 9, that the company benefits from a wider discount because of its integrated operations. This is the opposite of the premise relied on in Earnest’s benefits report. As Imperial’s Paul Masschelin, SVP, Finance, Administration & Controller told investor analysts, “With North American crude and product differentials really increasing significantly from 2010 forward, we really have been in an excellent position to capture this arbitrage. We only need to go back to last year where in the fourth quarter of 2013, we delivered the highest quarterly earnings in our history for the downstream and chemicals businesses.”

‘Arbitrage’ refers to Imperial’s ability to use heavy oil the company producers in their own refineries and sell refined product at market prices as if they paid prices for the crude feedstock at light oil premium rates.

“How reliable is the supply projection?” “I’d have to dig more deeply into the numbers to test them.” “How will you do that?” “Probably have to look at each oil sands project to see how much of the supply in the forecast is coming from projects that are already operating and under construction versus supply from projects that are, well, on producer’ wish lists.”

CAPP, Crude Oil Forecast, Markets and Transportation, June 2015, page 38.

In its 2015 report, CAPP included a disaggregation of operating, under construction and ‘growth’ projects. This feature in CAPP’s 2015 report is useful in identifying how dependent the outlook is on projects that are not yet committed to by oil producers along with helping to indicate the financing they will need to realize the supply projections. Regrettably, CAPP has not continued the practice of identifying ‘growth’ projects in its subsequent reports despite continuing to release supply outlooks that reflect rapid tar sands expansion.

National Energy Board, National Energy Board Report, Trans Mountain Expansion Project, OH-001-2014, May 2016.

National Energy Board, Living Oceans Society, Supplemental Written Evidence, Public Interest Evaluation, Gunton et.al., Exhibit C213-30-1, A4W0R4, December 1, 2015.

During the NEB review, the likelihood that CAPP’s outlook was overly ambitious because of its reliance on future supply from projects that were not yet committed to, or invested in, was brought to the Board’s attention. “Living Oceans Society and Conservation Foundation, Tsawout First Nation, and Upper Nicola all submitted a report authored by Dr. Gunton, Dr. Broadbent, Dr. Joseph, and Mr. Hoffele, dated May 2015, entitled “Public Interest Evaluation of the Trans Mountain Expansion Project” (Gunton Evaluation).”

Instead of properly responding to the risk inherent in a supply outlook dependent on projects that would take hundreds of billions of dollars of investment to bring to fruition, the Board dismissed the Gunton Evaluation. “Several participants, including Dr. Kathryn Harrison, City of Vancouver and those who submitted the Gunton Evaluation said that the Project could result in excess pipeline capacity. The Gunton Evaluation concluded that under both CAPP’S low and high growth forecast, surplus capacity would exist if the Project is built. The Board finds that CAPP does not have a low supply and high supply forecast. Consequently, the Board assigns low weight to the evidence in the Gunton Evaluation on this point.” Page 310 of the NEB Report.

“How much?” “Hard to say without crunching a lot of numbers, and the afternoon is ticking away. I’ve got to get this report done…but the investment needed has got to be into the hundreds of billions of dollars.”

Natural Resources Canada, Crude Oil Facts, Oil Sands.

“The oil sands accounted for 64% of Canada’s oil production in 2017 or 2.7 million barrels per day. The oil sands have an estimated $301 billion of capital investment to date, including $12.8 billion in 2017.” In 2013, approximately $215 million had been invested in the tar sands to generate approximately 2 million barrels a day of production.

Kat is looking at the CAPP 2013 forecast (page 36) which suggests that by the year 2030, Alberta’s tar sands will be producing more than 5 million barrels a day, or 3 million barrels a day more than in 2013. Such an aggressive outlook suggest that tar sands producers would need about $300 billion in investment to generate that volume of supply growth.

Alberta Energy Regulator, Alberta conventional oil and gas and oil sands capital expenditure, Website.

“I return to review the document and find the section I want. The US Joint Committee on Taxation said that Richard Kinder himself recommended “Project Tanya” to his fellow Enron board members in 1995—before he left to set up Kinder Morgan. Named after a hurricane, the scheme was designed so that Enron didn’t pay capital gains tax on earnings they made from selling corporate stock. What’s more, Enron’s auditor, Arthur Anderson, was paid half a million dollars for conjuring up Project Tanya—just the first in a string of schemes that continued until the company filed for bankruptcy.”

US Senate Committee on Finance, Report of Investigation of Enron Corporation and Related Entities Regarding Federal Tax and Compensation Issues, and Policy Recommendations, Volume 1: Report, Joint Committee on Taxation, February 2003, page 119.

Allan, Robyn, How Trans Mountain Project Will Pump Profits to Its Texas Based Owners, The Tyee, January 12, 2015.

“They slink away on high tide taking up most of the channel under the bridge.”

Anderson, Mitchell, Expert Engineers Deem Trans Mountain Too Dangerous, The Tyee, December 15, 2014.

The depth of the channel in Burrard Inlet is insufficient to fully load an Aframax tanker, so they are partially laden to a maximum of 550,000 barrels. Even with partial loading, tankers must exit the inlet in daylight on slack tide (high tide before it changes) so the window of opportunity for doing so is narrow.

That article says five oil tankers each month, but I’ve never seen more than two or three.”

Allan, Robyn, Need for, Commercial Feasibility, and Economic Impact of the Trans Mountain Expansion Project, Prepared for Tsleil-Waututh Nation, November 26, 2016, page 16.

Kinder Morgan claimed at the NEB hearing that ‘typically five tankers a month’ are loaded at Westridge.

Testing this claim, the author sought out tanker loading and market destination data and discovered that tidewater access was available at the dock, but it was not being used. Five tankers a month were not ‘typically’ being loaded at Westridge.

For the tankers that were loaded at Westridge, very few were destined to markets other than the US, despite the fact that in 2011 the NEB had granted Kinder Morgan 79,000 barrels a day of guaranteed dock access on the promise that markets in Asia would be developed.

Subsequent to the author identifying that very few tankers were destined to Asia, and even fewer were transporting heavy oil, the NEB stopped providing the data the author relied on to identify market destinations by type of crude loaded at Westridge. That is, the data the author relied on for the report cited above is no longer available. Not only did the NEB stop producing the data, the Board removed the historical statistics from its website. The historical NEB statistics were downloaded and are in possession of the author.

In 2011 there were fewer than three tankers a month loaded at Westridge, in 2012 and 2013 it was four a month. During Trans Mountain’s review, tanker loadings continued to decline but Kinder Morgan refused to correct their figure at the hearing and the Board did not compel them to. By 2016, the average vessel loadings at Westridge fell to 1.25 tankers a month, while the NEB report issued in May 2016 claims that ‘typically five’ a month are loaded. The author brought the error to the attention of the Board, but the Board refused to correct its report.

National Energy Board, Reconsideration Review, Trans Mountain Expansion Project, Trans Mountain Response to City of Burnaby Information Request No. 1, A6Q5Z6, page 4 for historical loadings at Westridge.

By refusing to acknowledge tanker loadings were not ‘typically five’ per month the NEB did not have to address obvious flaws in Kinder Morgan’s application. For example, Kinder Morgan was capable of loading five tankers a month at Westridge, but this was not taking place—dock capacity was underutilized. If dock capacity was underutilized, why was there an urgent need for tidewater access? If fewer than five tankers were being loaded, and most were destined for the US, where is the “Asian’ demand?

Further, if fewer tankers were loaded than Kinder Morgan claimed then the incremental risk to the marine environment would be under-represented in the risk assessments Kinder Morgan filed as evidence, since risk is a function of frequency time consequence. The greater the increase in tankers the greater the risk of a spill.

Kinder Morgan seems to have been concerned about releasing accurate tanker loading figures. The company refused to provide the author with updated figures on tanker loadings in spite of promises it would do so. Kinder Morgan eventually provided figures during the Reconsideration Review under a specific request from the City of Burnaby, as provided above.

When the author alerted the NEB to the fact that its May 2016 report provided an erroneous figure of ‘typically five’ tankers a month the Board refused to correct the figure. Subsequent to being provided updated and accurate figures proving that there are fewer than five a month, instead of providing accurate information in its Reconsideration Review Report, the NEB continued to mislead Cabinet, by stating that ‘typically five’ tankers a month are loaded at Westridge. By pretending that five tankers a month are loaded, the NEB does not have to address the obvious question, ‘why is tidewater access available and it is not being used?’

“It’s bad enough they only recover about fifteen percent of a conventional oil spill when it hits water,” Barbara says.

Living Oceans, Preliminary Mechanical Gap Analysis for the Enbridge Northern Gateway Project, 2011.

“During the best of weather conditions, responding to an oil spill is challenging. Generally, only 10 to 15 percent of spilled oil is recovered, based on typical estimates for open water recovery efficiencies for mechanical equipment (Oceans North, 2011).”

“The industry says bitumen doesn’t sink, but in 2010 there was this huge spill in Michigan. About twenty thousand barrels of dilbit leaked from an Enbridge pipeline into the Kalamazoo River. The condensate evaporated into the air, and the bitumen sank to the bottom and mixed with the river bed.”

Moore, Dene, Behaviour of diluted bitumen in dispute at pipeline hearings, iPolitics, February 6, 2013.

US Congress, Enbridge Pipeline Oil Spill in Marshall Michigan, Hearing Before the Committee on Transportation and Infrastructure House of Representatives, One Hundred and Eleventh Congress, Second Session, September 15, 2010.

US House Representative Member Mark Schauer “…largest oil spill ever in the Midwest…I saw the unimaginable there at home that day…my community lost its innocence that night and in subsequent days. One million gallons of heavy crude oil poured into the Talmage Creek and then into the Kalamazoo River, a tributary of Lake Michigan.” (There are 49 gallons in a barrel which equates 20,000 barrels of diluted bitumen).

“Just ten days before Enbridge’s pipeline ruptured,” says Barbara, “one of their vice-presidents told a US congressional committee that an oil spill simply couldn’t happen, no way—and then the pipeline ruptured.”

US Congress, Enbridge Pipeline Oil Spill in Marshall Michigan, Hearing Before the Committee on Transportation and Infrastructure House of Representatives, One Hundred and Eleventh Congress, Second Session, September 15, 2010.

US House Representative Member James Oberstar, “Two months ago, the Subcommittee on Railroads, Pipelines and Hazmat had a hearing on the integrity management of hazardous pipelines. During the hearing I questioned Mr. Richard Adams, the Enbridge vice president of U.S. operations for liquid pipelines, about the importance of identifying and responding immediately to pipeline rupture.

His comment, “Our response time from our control center can be almost instantaneous, and our large leaks are typically detected by our control center personnel…Ten days later, the pipeline burst. Ten days later after the hearing in this Committee.”

The response time was 17 hours, before the leak was detected.

US House Representative Member Mark Schauer, “The ironies are too many to cite. Just 10 days before, as Chairman Oberstar stated, an executive of Enbridge testified before this very Committee on its integrity management system and stated its control room could detect the smallest of leaks. As we learned, it failed.”

“The Kalamazoo spill happened three years ago,” she says, “but it still isn’t cleaned up. So much for ‘It won’t spill and if it does, it’ll get cleaned up.’ It took seventeen hours before Enbridge figured out it had a leak, but the industry says nobody will ever make that mistake again. They say they’ll get there quickly enough before the bitumen sinks.”

Moro, Teviah, Enbridge is still cleaning up three years after Kalamazoo River oil spill, Hamilton Spectator, October 16, 2013.

US National Transportation Safety Board, Pipeline Rupture and Oil Spill Accident Caused by Organizational Failures and Weak Regulations, Press Release, July 10, 2012.

US National Transportation Safety Board, Enbridge Incorporated Hazardous Liquid Pipeline Rupture and Release Marshall, Michigan July 25, 2010.

McGowan, Elizabeth and Song, Lisa, The Dilbit Disaster: Inside The Biggest Oil Spill You’ve Never Heard of, Part 1, Inside Climate News, June 26, 2012.

“What about the spills that have happened in the ocean?” I ask. “That’s just it. Dilbit’s hardly been shipped on the ocean. There isn’t any spill experience. I mean, we’re talking about really, really, small amounts of dilbit shipped by sea. The researchers do lab tests, but of course, the findings are inconclusive. Convenient, isn’t it?”

Anderson, Mitchell, Spill from Hell: Diluted Bitumen, The Tyee, March 5, 2012.

“Here’s the question of the day for you, Babs. What’s Kinder Morgan’s pipeline spill record like?” I ask.

Tsleil-Waututh Nation, Sacred Trust, What is Kinder Morgan’s Record of Spills, Website.

“Kinder Morgan’s a felon, Trainer.” “A felon?” “Well, let’s just say that safety isn’t their first priority. Here’s the answer to the question of the day: One of its gas lines exploded in Walnut Creek in California in 2004. The fireball killed five people and seriously injured four. I’ll send you a picture.”

Lee, Henry, K., Energy firm convicted in Walnut Creek pipeline blast that killed 5, SFGate, September 21, 2007.

Taugher, Mike, Corporation to pay $15 million for Walnut Creek blast, East Bay Times, September 27, 2007.

“And did you know that the existing Trans Mountain pipeline sprung a leak in a residential neighbourhood, in Burnaby in 2007? It was after Kinder Morgan bought Trans Mountain. The pipeline squirted so much oil into the air that it stained the entire neighbourhood. Kinder Morgan knew it was at fault, but—get this—it took the municipality to court with a frivolous case to delay paying damages. I’ll send you a picture.”

Transportation Safety Board of Canada, Pipeline Investigation Report, Trans Mountain Pipeline LP, July 24, 2007.

Page 6-7 of the report explains that Kinder Morgan employees turned off the wrong valve and exacerbated the leak because it continued for almost a half hour longer than it should have if correct procedures had been followed.

“KMC checked the location of the Westridge Pipeline on the design drawings against the as-built pipeline drawing, dated April 1957.” Page 3 explains how the outdated drawings from 1957 were relied upon.

Granger, Grant, The day oil rained down on Burnaby, Burnaby Now, July 21, 2017.

Cathcart, Jesse, Photos: Oil spill showers Burnaby neighbourhood in July 2007, Vancouver Sun, October 3, 2011.

Lee, Jeff, Burnaby soured to Kinder Morgan after 2007 spill: mayor (with video), Vancouver Sun, May 15, 2014.

“Okay. Canada’s oil producers invested south of the border, instead of at home.”

Allan, Robyn, Keep the oilsands wealth at home, Vancouver Sun, May 17, 2012.

Suncor, Refining, Website reference to $540 invested in upgrades at Commerce City , Colorado, to allow for more oil sands products.

Harding, John, Husky and BP forge US$5.5B oilsands alliance, Financial Post, December 5, 2007.

Reuters, UPDATE 2—Cenovus Illinois refinery units in start-up mode, November 18, 2011.

Renshaw, Jarrett, Exxon’s new oil-by-rail terminal in Canada gears up for U.S shipments, Reuters, January 15, 2015.

“Of the two million barrels of tar sands Canada supplies each day, about 1.4 million barrels a day is exported to US refineries.”

CAPP, Forecast, Markets and Transportation June 2013. For supply 2.2 million barrels a day of tar sands in 2012 (actual figures is what Trainer relies on) page 37.

EIA, Petroleum and Other Liquids, Crude Imports, 2012, Heavy Sour. For imports. (518,802,000 barrels for 2012/365 days = 1.42 million a day).

“The Federation estimates that eighteen thousand jobs are lost for every four hundred thousand barrels of dilbit exported.”

Polczer, Shaun, Oilsands pipeline to U.S. a job killer: labour group; Study says 18,000 jobs in the balance, Calgary Herald, April 17, 2007.

Coles, Dave, Pipeline would ship oil and jobs south, Toronto Star, August 8, 2010.

Alberta Federation of Labour, Intervention, Trans Mountain Expansion Project, NEB Hearing Registry. See in particular, Written Final Argument.

I settle in on a Sunday morning to listen to Kinder Morgan’s annual investor day, more than six hours of presentations to a room full of financial analysts. These are the people who follow the company and write reports, telling their investors whether to buy, hold, or sell the company’s stock.

Kinder Morgan Inc., Website, Media and Investor Center, Presentations and Webcasts.

Audio recordings are no longer available on the website; however, slide presentations continue to be provided. Audio in author’s possession.

Richard Kinder himself kicks it off with his corporate overview. “We’re enthusiastic about the future.” He doesn’t talk about Trans Mountain’s expansion although he refers to the company’s backlog. “Steve Kean is going to talk to you about our backlog, which is 14.8 billion dollars in identified projects to be built over the next few years.” I bet Trans Mountain’s expansion is in there.

Kinder Morgan Inc., Website, Media and Investor Center, Presentations and Webcasts, Kinder Morgan 2014 Analyst Conference, January 29, 2014, minute 6:49.

Kean worked at Enron for twelve years, reaching the position of executive vice-president and chief of staff prior to Enron’s demise. He’s among the Enron alumni who don’t mention on their Kinder Morgan website biographies that they ever worked at Enron. I did some research on him; he must be a pretty smart guy because it turns out he unloaded his Enron shares for five million bucks before the stock plummeted and the company filed for bankruptcy.

Allan, Robyn, How Trans Mountain Project Will Pump Profits to Its Texas Based Owners, The Tyee, January 12, 2015.

United States District Court, Class Action Complaint for Violation of the Federal Securities Laws, Amalgamated Bank, et.al. v. Kenneth L. Lay, et.al., page 53.

Kean begins to talk about Kinder Morgan Canada. “The big story here, of course, is the 5.4 billion dollar project that’s an end of 2017 completion.”

Kinder Morgan Inc., Website, Media and Investor Center, Presentations and Webcasts, Kinder Morgan 2014 Analyst Conference, January 29, 2014, minute 52:50.

It should be noted that Kinder Morgan refers to the project as $5.4 billion whereas the NEB refers to it in its reports as a $5.5 billion project. The difference is because Kinder Morgan nets off a portion of the Firm 50 fund granted to Kinder Morgan to help pay for regulatory review while the NEB does not.

“Pipelines are controversial. More controversial than they used to be,” Kean warns. “Oil sands is controversial, and, ah, so, we have to…we have to convince a broad group of people that it’s okay…it’s okay…this project’s okay.”

Kinder Morgan Inc., Website, Media and Investor Center, Presentations and Webcasts, Kinder Morgan 2014 Analyst Conference, January 29, 2014, minute 53:32.

“Construction in Canada has always been a challenge,” Kean says. Then he assures his audience that Kinder Morgan is protected from construction cost overruns. “We’ve got our commercial contracts done. They’re binding. They’ve been approved by the NEB.”

Kinder Morgan Inc., Website, Media and Investor Center, Presentations and Webcasts, Kinder Morgan 2014 Analyst Conference, January 29, 2014, minute 48:33 and minute 53:50.

Sure enough, the NEB already held a hearing to approve the commercial contract terms and the pipeline tolls Trans Mountain’s shippers will pay once the expansion is operating.

NEB, Application for Approval of the Transportation Service and Toll Methodology for the Expanded Trans Mountain Pipeline System, RH-001-2012.

NEB, Application for Approval of the Transportation Service and Toll Methodology for the Expanded Trans Mountain Pipeline System, RH-001-2012, Appendix 7 Final Form of the Firm Service Agreement, A3E7D3.

Anderson also talks about Kinder Morgan’s contract terms with shippers. He says thirteen different companies have committed to long term “take-or-pay” contracts, tying them into seven hundred thousand barrels a day of capacity once the expansion is complete. Now I get it. Take-or-pay contracts means pipeline users—oil companies—agree to pay tolls whether or not they use the capacity they commit to. This is how Kinder Morgan is assured it will receive a steady stream of revenue.

Kinder Morgan Inc., Website, Media and Investor Center, Presentations and Webcasts, Kinder Morgan 2014 Analyst Conference, January 29, 2014, hour 3:22:17.

Some of the demand for pipeline capacity isn’t for the new pipeline; it’s for space on the existing pipeline. Oil companies that currently negotiate every month for space on the Trans Mountain pipeline to ship products to BC and Washington State want to lock in capacity for the petro-products they already deliver to land destinations. I bet companies like BP and Tesoro—who own refineries in Cherry Point and Anacortes in Washington—and Suncor and Imperial—who ship refined oil products on the existing line to Burnaby to sell in gas stations throughout the Lower Mainland—have signed up as long-term shippers.

NEB, Trans Mountain Pipeline ULC Application for the Trans Mountain Expansion Project, Hearing Order OH-001-2014, Written Evidence of BP Canada Energy Group ULC, A4L8E2.

“BP Canada is currently a shipper on the Trans Mountain Pipeline system, which connects directly to BP's Cherry Point Refinery, having a processing capacity of 235 kpbd, located in the Puget Sound area of Washington State…BP Canada has made a firm commitment to ship on the proposed Expansion by executing a Transportation Services Agreement which will be in effect for a twenty (20) year term… The Expansion will enhance market access and is therefore important to BP as marketer, refiner and producer…the additional capacity afforded by the Expansion will enhance the security of supply of Canadian crude oil to BP's Cherry Point Refinery…” (emphasis added).

NEB, Trans Mountain Pipeline ULC Application for the Trans Mountain Expansion Project, Hearing Order OH-001-2014, Written Evidence of Canadian Oil Sands, Cenovus, Devon, Husky Oil, Imperial Oil, Statoil, Suncor, Tesoro, Total---the TMX Shippers, May 27, 2015. Confirms that Tesoro (now Marathon) as well as Suncor and Imperial wish to lock in capacity for delivery to existing markets.

Anderson talks about the earnings coming from operating the existing pipeline, earnings that go directly to Texas. “It’s in the one-hundred-and-thirty-million-dollar range,” he says.

National Energy Board, Application for Approval of the Transportation Service and Toll Methodology for the Expanded Trans Mountain Pipeline System (RH-001-2012), Exhibit C15-12, Transcript of Ian Anderson Investor Presentation, February 13, 2013, page 3.

National Energy Board, Trans Mountain Pipeline ULC, Application for 2013 Tolls, Schedules for 2013 ITS. See ITS 31 for total revenue Line 8 of which $130 million is approximately half.

National Energy Board, Trans Mountain Pipeline ULC, Application for 2013 Tolls, Tariff No. 90. Toll rate Edmonton to Burnaby is approximately $2.45 per barrel equates roughly to double the per barrel cash flow (EBITDA) to Kinder Morgan in Houston.

Anderson tells investors that once the second pipeline is built, the cash Kinder Morgan gets to keep “goes up to eight hundred and fifty million dollars.” That’s a big increase in cash that gets siphoned from the Canadian economy every year. On a per barrel basis it’s—what? I do the math. It’s more than twice what they get now. After expansion, Kinder Morgan expects to take home to Texas two dollars and sixty cents a barrel, more than twice what it gets now, even if the shippers don’t use the pipeline. No wonder he’s excited about the expansion.

National Energy Board, Application for Approval of the Transportation Service and Toll Methodology for the Expanded Trans Mountain Pipeline System (RH-001-2012), Exhibit C15-12, Transcript of Ian Anderson Investor Presentation, February 13, 2013, page 3.

The math is $850 million/365 days/890,000 b/d = $2.61 per barrel. One of the issues is that the toll rate on the existing pipeline goes up by more than double to help fund the expansion. This means that to deliver crude oil and refined product to BC, it will cost more than double what it costs now because the existing pipeline toll rates will help to cross subsidize the cost of building the new pipeline to serve foreign markets.

For some, they get long-term access to a pipeline they already use to deliver crude and petroleum products to existing markets, but they will have to pay more than twice what they now pay. The increase in tolls will be passed on to consumers at the pumps, I bet; what do oil producers care?

Allan, Robyn, Trans Mountain expansion will cost B.C. motorists over $100 million a year, National Observer, March 27, 2017.

Allan, Robyn, Trans Mountain expansion will raise pump prices, Vancouver Sun, March 20, 2018.

Anderson explains that something called “book taxes” are added back to earnings, so his audience doesn’t need to worry about Kinder Morgan having to pay them. Trans Mountain doesn’t expect to pay its taxes? I grab my computer, close the lid of the toilet and sit on the seat so I can check the slides that accompany Anderson’s presentation. There it is. “Trans Mountain Distributable Cash Flow”—a five-year table laying out how Kinder Morgan pays very little, and often no, corporate taxes in Canada.

Allan, Robyn, Trans Mountain Pipeline: Big Bucks for US Investors Peanuts for Us, The Tyee, November 17, 2014.

“You bet it’s war. They’re setting us up,” Kat says. “Who is?” Barbara asks. “These oil companies.”

Linnett, Carol, Post Media Gets Away With Running Unmarked Oil Advertorials, The Narwhal, June 20, 2014.

Uechi, Jenny, and Millar, Mathew, Presentation suggests intimate relationship between Post Media and Oil Industry, Vancouver Observer, February 5, 2014

“But it’s the last thing we need,” says Liz, looking at Kat. “Canada can’t meet its greenhouse gas emission targets if the oil sands keep growing. Greenhouse gases are warming the planet. In order to stop the world from frying, we need to stop growth.” Liz slides from the log to sit on the sand too and wraps her arms around her knees.

Dinshaw, Fram, Over 100 scientists call for oil sands moratorium, National Observer, June 10, 2015.

Oil Sands Moratorium, Over 100 Leading Scientists Call for a Moratorium on New Oil Sands Development, June 10, 2015.

“Fifty million dollars a day.”

Vanderklippe, Nathan, Oil price gap costs producers $50-million a day, Globe and Mail, March 12, 2012.

“Mr. Potter based his analysis on what he called, in a recent report, the “double discount” facing the Canadian oil patch.

“That’s an $18-billion annual hit to companies, and it could endure into 2013 or longer, according to a new analysis of the damage wreaked by an ongoing supply glut.”

Allan, Robyn, Bitumen’s Deep Discount Deception and Canada’s Pipeline Mania: An Economic and Financial Analysis, April 2, 2013, page 11-12.

The author’s report shows that both the $50 million a day and its extrapolation into $18 billion a year is inappropriate and flawed analysis and that such financial claims are false.

When CIBC was contacted for the source of the $50 million a day claim, the author was provided a copy of a March 6, 2012, CIBC Institutional Equity Research Update titled “Double Discounting of Canadian Crudes”. In the March 6 report, CIBC says, “WTI and Brent are disconnected from a pricing perspective” and “for US Bakken producers, and for Canadian producers…prices (are) being even further discounted vs. WTI.” But the report offers no dollar estimate on the potential impact. Therefore, the author asked CIBC which report cited the $50 million a day claim. A CIBC Institutional Equity Research Industry Update dated March 20, 2012 titled “Differentials—The $18 billion Opportunity Cost” was provided. That document states that “Producers (are) Missing Out On $50 Million/Day at Current Differentials”.

This report was prepared by CIBC after the newspaper interview. There are no calculations, or price references to explain how the figure was estimated. That is, it cannot be confirmed from the March 20, 2012 document how the $50 million per day is derived. CIBC offers no underlying assumptions for oil prices or product volumes.

The text of the March 20th report states, “…discounts on SCO reached US $23.00/Bbl or 24% vs. WTI in early February, while WCS pricing ballooned to US $35.50/Bbl or a 37% discount vs. WTI…At current levels, the oil sands industry would post an $18 billion/year opportunity cost.” An examination of daily prices in February 2012 reveals that prices were volatile from day to day, and other days, in that month, had they been selected would not have produced a ‘loss’ but a ‘gain.’ Further, applying a discount to all barrels produced is an egregious error since few barrels are exposed to the spot market (daily) price.

The CIBC analyst was unwilling to provide price and volume figures but agreed that referring to any estimate as a loss is incorrect because it is an “opportunity cost of missed revenue to producers so all we did was take heavy volumes multiplied by the differential between wcs and maya and the light volumes multiplied by the differential between sco and brent. The numbers will vary greatly depending on what day in the past two years they were run.” This approach as explained by CIBC made little sense since neither WCS or SCO are priced against Maya or Brent.

The explanation offered was also inconsistent with the March 20th report where only WTI, WCS and SCO (Synthetic Crude Oil, or upgraded bitumen) prices are mentioned, not Brent or Maya. When pressed for the underlying data to support the $50 million a dollar claim, the response was, “I don’t have that data anymore.”

There is no transparency or accountability for the $50 million per day CIBC estimate. Further, CIBC made a huge error by applying whatever discounts it relied on to all barrels produced.

Without checking the source of the $50 million a day claim, numerous politicians and lobbyists adopted it and it was widely reported in the media. Natural Resource Minister Joe Oliver used the $50 million a day figure for a December 2012 speech. NRCan confirmed via email with the author that Oliver got the figure from the Globe and Mail article.

Cenovus CEO Brian Ferguson doubled the figure to $100 million a day in January 2013. The Canadian Chamber of Commerce made the $50 million a day claim a focal point of their September 2013 report funded by pipeline companies and oil producers. The Canadian Chamber of Commerce in its pamphlet indicates they relied on the Globe and Mail article and Mr. Oliver’s speech. That is, the Chamber of Commerce was relying on a statement that was incorrect when it was made and continued to be incorrect when the Chamber relied on it, over a year and a half later.

Canadian Chamber of Commerce, $50 million a day, September 17, 2013.

“Our company analyzed the oil sands’ risks. We’ve concluded that most of the bitumen reserves will probably stay in the ground, which means oil sands companies are not a good investment for our clients. At the same time, a number of our clients want the bitumen to stay in the ground—they’re concerned about human-caused climate change, pollution, orcas, salmon, a future for their kids—so they’ve directed us to divest their holdings. The industry has a term for bitumen reserves that have become liabilities. They call them ‘stranded assets.’”

Bank of England, Mark Carney, Governor of the Bank of England, Speech, Breaking the Tragedy of the Horizon – climate change and financial stability, Lloyds of London, September 29, 2015.

Meyer, Carl, Bank of Canada warns ‘fire sales’ of carbon-intensive assets could ‘destabilize’ financial system, National Observer, May 16, 2019.

Bank of Canada, Financial System Review, 2019, Vulnerability #5 Climate Change, Webpage.

“My boss asked the same question, and they were cagey at first. Then they admitted the fifty million dollars a day comes from an old newspaper article that quoted a bank analyst. They didn’t do any analysis. They just took the figure.”

Vanderklippe, Nathan, Oil price gap costs producers $50-million a day, Globe and Mail, March 12, 2012.

Allan, Robyn, Bitumen’s Deep Discount Deception and Canada’s Pipeline Mania: An Economic and Financial Analysis, April 2, 2013.

Bitumen’s Deep Discount Deception provides the paper trail revealing that there was no analysis to support the figure; discounts should not be applied to all barrels; and none of the public figures who relied on $50 million a day checked to ensure it made market and economic sense.

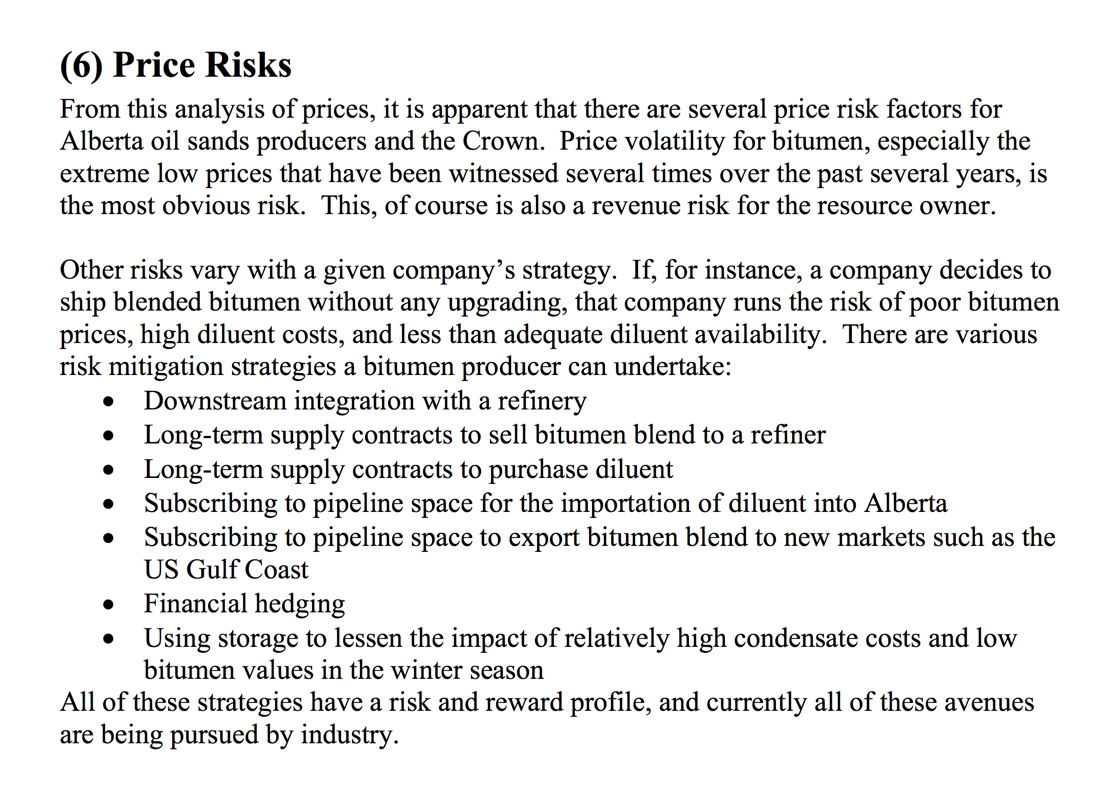

“Business strategies like what?” asks Liz.

Alberta Royalty Review 2007, Oil Sands Economics and Royalty Series, Appendix A Technical Report OS#1, Markets and Pricing for Alberta Bitumen Production, Alberta Department of Energy, page 20-21.

For more than a decade, tar sands producers have been aware of the business risks inherent in exporting bitumen. The following is an excerpt from the Appendix A of the 2007 Alberta governments Royalty Review outlining the business strategies tar sands producers engage in to avoid exposure to the price risk.

Allan, Robyn, Scotiabank report a work of fiction, Vancouver Sun, March 4, 2018.

Allan, Robyn, Premier Notley’s claimed $15 billion annual benefit from Trans Mountain exposed as false by her own budget, National Observer, June 7, 2018.

Allan, Robyn, Cenovus CEO should get facts straight, Times Colonist, February 2, 2018.

Allan, Robyn, The discount for Alberta’s oil isn’t always that steep, Calgary Herald, February 24, 2018.

“Which reminds me, True” says Wes. “I dug deeper on that tax information you sent me on Kinder Morgan’s book taxes. Looks like it set up a web of companies to take advantage of loopholes in the international tax treaty, so it barely pays corporate taxes at all. It’ll rely on those same loopholes to avoid paying taxes after the expansion. The so-called government revenues to fund social programs? They’re make-believe too.”

Allan, Robyn, How Trans Mountain Project Will Pump Profits to Its Texas Based Owners, The Tyee, January 12, 2015.

FALL

“The NEB’s set a tight timeline, narrowed its scope, limited participation and made the criteria for approving intervenors really stringent. What bothers me most is that they’ve removed cross-examination.”

National Energy Board, Trans Mountain Expansion Project, Robyn Allan, Notice of Motion, April 4, 2014.

Nikiforuk, Andrew, No Cross-Exam in Trans Mountain Hearing Hurts NEB Credibility: Economist, Tyee, April 23, 2014.

National Energy Board, Trans Mountain Expansion, Hearing Order, OG-001-2014, A3V6I2, April 2, 2014.

Page 3: “The Board now has 15 months to complete its review. It must submit its Report to the Governor in Council no later than 2 July 2015. This represents the maximum time to complete the review, subject to any modifications allowed under the National Energy Board Act (NEB Act). The deadlines in this Hearing Order are critical to allow this hearing to be completed within the legislated time limit.”

‘“The Board does not intend to consider the environmental and socio-economic effects associated with upstream activities, the development of oil sands, or the downstream use of the oil transported by the pipeline.”’ She looks up from the document. “That means the Board will not consider greenhouse gases from increased oil sands supply, their impact on climate change, or other environmental consequences, like rapidly expanded tailings ponds to hold the toxic by-products from supply expansion.”

National Energy Board, Trans Mountain Expansion, Hearing Order, OG-001-2014, A3V6I2, April 2, 2014, page 18.

2014

SPRING

Or the part where Kinder Morgan blames whales for getting in the way of oil tankers. “Kinder Morgan believes its project will have a significant adverse effect on the sensory disturbance of orcas that use the shipping lanes.”

Allan, Robyn, Endangered orcas swim along Kinder Morgan’s oil tanker route, Vancouver Observer, May 13, 2014.

“Breaking News—Canada Losing Fifty Million Dollars a Day, Every Day Trans Mountain Pipeline Not Built.” I click the link. The news article cites a Canadian Chamber of Commerce report as the source for the alleged fifty-million-dollar-a-day loss. I access the report.”

Canadian Chamber of Commerce, $50 million a day, September 17, 2013.

“I heard back from the author of the so-called report.” Flick walks further into the bush, steps over a fallen tree trunk and crouches. “What did you learn?” he asks, staring at the decaying log. He reaches to move aside some leaves and other debris. The figure wasn’t checked. It was taken from the Globe and Mail article and Joe Oliver’s speech.” I close my eyes and tilt my face toward the sky to feel the sun’s warmth. It’s so much warmer today than earlier in the week. “Know where Oliver got his number from?” I ask Flick. He doesn’t answer, so I tell him. “From the Globe article.”

“…we had two written sources for the figure: the globe article and a speech by Minister Oliver.” Email from Chamber of Commerce.

Allan, Robyn, Bitumen’s Deep Discount Deception and Canada’s Pipeline Mania: An Economic and Financial Analysis, April 2, 2013.

The author’s research report on why the $50 million a day was not accurate or reliable was publicly available before the Chamber prepared its pamphlet and Bitumen’s Deep Discount report had been discussed in a variety of media articles. It is disturbing that the Canadian Chamber of Commerce would base its September 2013 report on a figure cited in a newspaper article from a year and a half earlier without checking to see how it was derived.

Post Media, Claims that landlocked oil costing Canada billions in revenue are ‘bogus’ economists say, National Post, June 3, 2013.

Nikiforuk, Andrew, Bitumen Bottleneck and Pipelines Fix a Myth: Economist, The Tyee, April 3, 2013.

Allan, Robyn, Oil Sands ‘Money Left on the Table’ and More Myths, The Tyee, April 11, 2013.

CIBC Has No Data to Back Up $50m Loss Per Day Tar Sands Claim, The Narwhal, April 4, 2013.

“I tracked down the analyst identified in the article and asked him how he got the fifty-million-dollar figure.” “Wait, don’t tell me. He said you can’t handle the truth?” “Pretty close. He actually said, ‘I don’t have that data anymore.’ The analyst didn’t prepare a report. There’s no explanation of how he came up with that figure, and he doesn’t have data to back it up. He brushed me off when I pressed him. He told me, ‘We typically only deal with institutional investors.’”

Allan, Robyn, Bitumen’s Deep Discount Deception and Canada’s Pipeline Mania: An Economic and Financial Analysis, April 2, 2013.

Correspondence with analyst via email. In possession of author.

Intervenors discredited Enbridge’s benefits figures during cross-examination at the Northern Gateway hearing, so the Board determined that as long as market options were available it didn’t matter if economic benefits materialized.

National Energy Board, Northern Gateway Report, Volume 2, Considerations, December 19, 2013, page 332.

“…in final argument, several parties took the position that the results of (Enbridge’s benefits analysis was) unreliable. The Panel is of the view that new pipelines connecting producing regions with consuming regions change market dynamics in ways that cannot easily be predicted…it is difficult to determine the exact impact that a major project such as the Enbridge Northern Gateway Project may have on netback prices once it is placed into service. The panel finds that…the project would significantly expand and diversify the market options for western Canadian crude oil supply which would contribute to the realization of full market pricing over the long term.” (emphasis added).

“I have included an additional section for our report that follows the money and shows how the project is commercially challenged and not financially viable despite Kinder Morgan’s promises.”

Allan, Robyn, Government aid key to Trans Mountain pipeline expansion, Vancouver Sun, April 30, 2018.

Allan, Robyn, What’s behind Kinder Morgan’s May 31 ultimatum—follow the money, National Observer, May 15, 2018.

“Okay. The US parent company, Kinder Morgan Inc., told the National Energy Board it would provide all financing for the Trans Mountain expansion project. I’ve linked the reference, and you can check it when you review what I’ve sent.”

National Energy Board, Trans Mountain Pipeline Expansion, Reply Motion 6, Robyn Allan, December 7, 2014.